There are no products in your shopping cart.

| 0 Items | £0.00 |

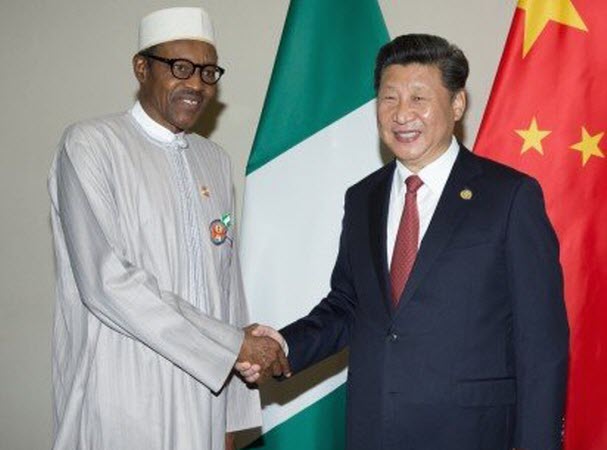

NIGERIA has been warned that she risks losing several key national assets to China in the event that the country defaults in paying back loans obtained from Chinese banks which is currently put at $3.48bn.

According to economists and financial experts, Nigeria is dangerously exposed to Chinese banks as a result of her growing debt profile. Like many African countries, Nigeria has benefitted from China's Belt and Road Initiative (BRI), a global infrastructure development strategy adopted by the Chinese government in 2013 to invest in nearly 70 countries and international organisations.

A 2019 study conducted by global economic consultants Cebr forecasted that BRI was likely to boost world gross domestic product (GDP) by $7.1trn per annum by 2040. However, several African countries have had problems with the programme as they have struggled to pay their debts, resulting in their national assets being confiscated.

For instance, Uganda is facing the threat of its only international airport being seized following its inability to repay a $207m loan obtained on November 17, 2015 from the Export-Import Bank of China. Thus loan, which has a maturity period of 20 years, was part of deal signed with Chinese lenders under which Uganda will have to surrender its only international airport if she defaults.

According to the Uganda Civil Aviation Authority, some provisions of the financing agreement with China exposed the Entebbe International Airport. China has reportedly rejected recent pleas by Uganda to renegotiate the toxic clauses of the 2015 loan.

Experts have advised Nigeria's federal government to properly review its loan agreements with China to save the country from facing a situation similar to that of Uganda. Idakolo Gbolade, the chief executive of SD&D Capital Management, warned Nigeria might forfeit certain assets in the event of a loan default.

Mr Gbolade said: “Yes, it is very possible. If you remember about a year ago, there was serious concern in the National Assembly on the loans given by the Chinese Exim Bank to us, and I am sure the loan clause also includes forfeiture of national assets.”

Professor Akpan Ekpo, an economist from the University of Uyo, said the development in Uganda was worrisome and exemplified some of the dangers of borrowing from external sources. He, therefore, advised the government to ensure that loan agreements with China were properly appraised.

Professor Sheriffdeen Tella of the Olabisi Onabanjo University, Ogun State, added: “It could happen to any African country because they are all thinking of borrowing. However, I think that since people have kept the conversation alive now, the government will be very careful with loans collected from China.

“There is, however, the need for an assessment of government external debt from different sources now. We have to start looking at it and there is a need to study the documents that contain the agreements of some of these loans to prevent a similar occurrence."