There are no products in your shopping cart.

| 0 Items | £0.00 |

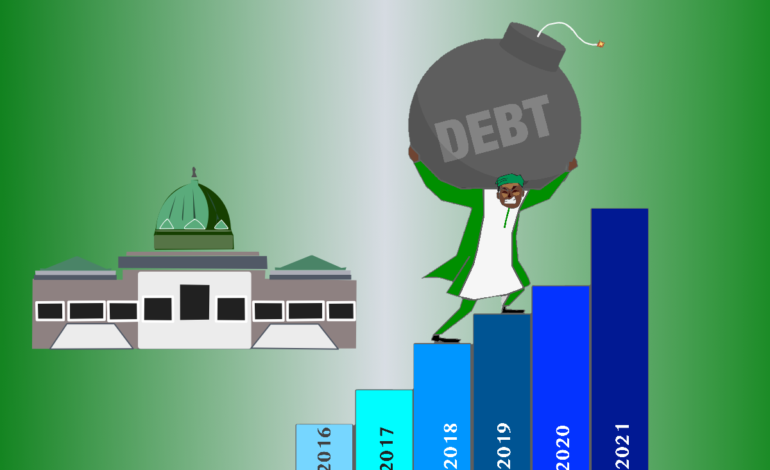

NIGERIA spent a total of N445.4bn ($1.08bn) on debt servicing during the second quarter of 2021 according to statistics just published by the Debt Management Office (DMO) which show a massive increase in borrowing to fund the government's budget.

Hit hard by the coronavirus pandemic, Nigeria has had to borrow heavily over the last two years, with about one third of the 2021 budget being funded by external borrowing. Nigeria's has an estimated budget of $33bn for 2021 but due to weak crude oil sales,. the government has had to borrow from international lenders like the World Bank, her International Monetary Fund and the African Development Bank.

According to the DMO data, from April to June 2021, Nigeria spent N322.7bn on domestic debt servicing, while N122.7bn was spent on external debt servicing. For domestic debt, Nigeria spent N258bn in April, N42.4bn in May and N22.3bn in June this year.

A breakdown of the statistics shows that the federal government spent a total of N322.7bn on the payment of interest, with N50.3bn expended on the redemption of matured Nigeria treasury bills between April and June 2021. For external debt servicing, commercial loans came at a cost of $157,012.17, multilaterals with a cost of $103,732.70 and bilateral loans had a cost of $38,220.88.

DMO director-general, Patience Oniha, disclosed that the Nigeria’s total public debt stock rose from N33.11tn as of March 31, 2021 to N35.47tn as of June 30, 2021. This shows an increase of N2.36tn or 7.13% within the three-month period.

Nigeria's debt to gross domestic product ratio rose from 21.13% to 21.92% within the second quarter of this year. At the end of the second quarter, a breakdown of external debt stock showed that multilateral debt from the World Bank Group and the African Development Group led the list of Nigeria’s creditors with a share of 54.88%.

In a recent report, accountants PwC Nigeria, said that the increasing cost of servicing debt continued to weigh on the federal government’s revenue profile. It added: “Actual debt servicing cost in 2020 stood at N3.27tn and represented about 10% over the budgeted amount of N2.95tn.

“This puts the debt-to-revenue ratio at approximately 83%, nearly double the 46% that was budgeted. This implies that about N83 out of every N100 the federal government earned was used to settle interest payments for outstanding domestic and foreign debts within the reference period.”

According to PwC Nigeria, in 2021, Nigeria's federal government planned to spend N3.32tn to service its outstanding debt. This is higher than the N2.95tn budgeted for debt servicing in 2020.