There are no products in your shopping cart.

| 0 Items | £0.00 |

NIGERIA'S external debt-to-revenue ratio ballooned to 400% last year from 8% in 2011 as a result of increased federal government borrowing according to former Central Bank of Nigeria (CBN) governor Mallam Lamido Sanusi.

Warning that the level of borrowing is becoming alarming, Mallam Sanusi said Nigeria has a debt services ratio of up to 96% but there are certain other elements of it that analysts have not paid attention to. Lamenting the situation while participating in an online roundtable discussion tagged: Debt Relief for a Green and Inclusive Recovery in Nigeria”, organised by Heinrich Böll Foundation, Mallam Sanusi said action needs to be taken.

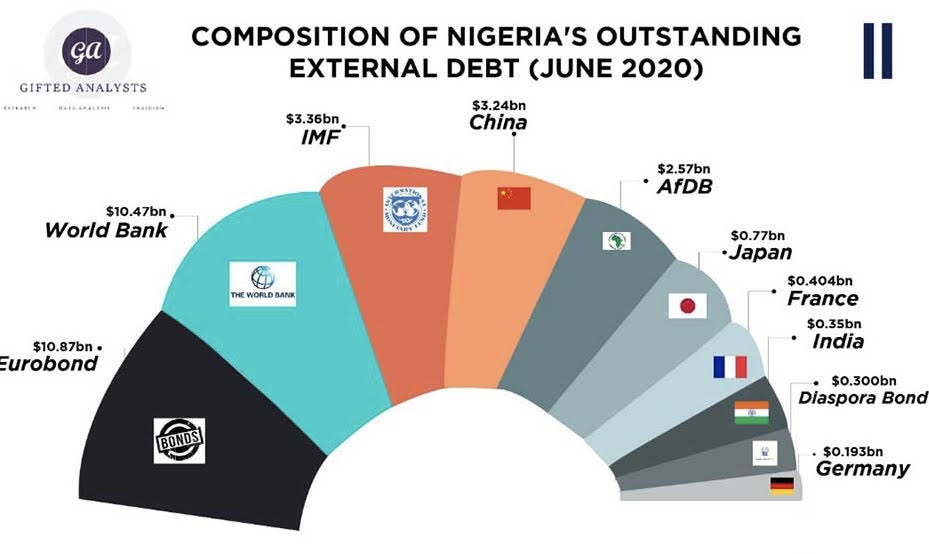

Earlier this week, Nigeria Debt Management Office (DMO) warned that the federal government is storing up problems for the future with its increased borrowing from the CBN As of December 2020, Nigeria's public debt was N32.9trn ($86.3bn) and of this total, N12.7trn ($33.3bn) was external debt contracted by the federal government, while N20.2trn ($53bn) was domestic debt, including loans taken from banks.

Acknowledging that Nigeria is sitting in a ticking time-bomb, Patience Oniha, the director-general of DMO, blamed the problem on the Covid-19 pandemic. She said the rate of borrowing had started to come down until coronavirus forced Nigeria, like many other nations, to increase its borrowing in order to buoy the economy.

Adding his voice to the concerns, Mallam Sanusi said: “If you go through the CBN statistical bulletin, in 2011, the total federally collected revenue from all sectors was N18.9trn at 165 naira to the dollar. This will have placed federally collected revenue in 2011 at $55.5bn.

“Meanwhile, debt at that time was $5bn so we had an external debt to external revenue of about 8% in 2011 but by 2020 we had an external debt of about $33.4bn and all revenues in 2020 were about $8.3bn. So the debt to total revenue ratio moved from 8% to 400% between 2011 and 2020.

“This is a serious red flag that I’ve not seen being pointed out in the conversation around debt sustainability especially given the facts that exports are yet to be diversified. You do not service debt out of gross domestic product (GDP), you service debt out of revenues.”

Nigeria’s debt position has been a source of concern for development experts in recent years, especially in the midst of dwindling oil revenue. Mallam Sanusi, pointed out that the debt to GDP ratio is a useless metric as it disguises the fact that Nigeria earning very little revenue outside crude oil.