There are no products in your shopping cart.

| 0 Items | £0.00 |

NIGERIA'S Debt Management Office (DMO) has warned that the federal government is storing up problems for the future with its increased borrowing from the Central Bank of Nigeria (CBN).

As of December 2020, Nigeria's public debt was N32.9trn ($86.3bn) according to the most recent official data available. Of this total, N12.7trn ($33.3bn) was external debt, contracted by the federal government, while N20.2trn ($53bn) was domestic debt, including loans taken from banks.

Of the total domestic debt amount, the federal government owes N16trn ($42bn) while the balance was loans taken out by state governments and the Federal Capital Territory. With the coronavirus pandemic hitting industrial output hard and leading to weak demand for crude oil, the federal government has had to step up borrowing, with about one third of the 2021 budget being borrowed.

Last week, Governor Godwin Obaseki of Edo State reported that Nigeria was in huge financial trouble, alleging that the federal government printed N60bn in March to help fund its federal allocation to the states. He also expressed concern over the country’s increased borrowing, saying it was wrong to continue borrowing without a tangible plan for debt repayment.

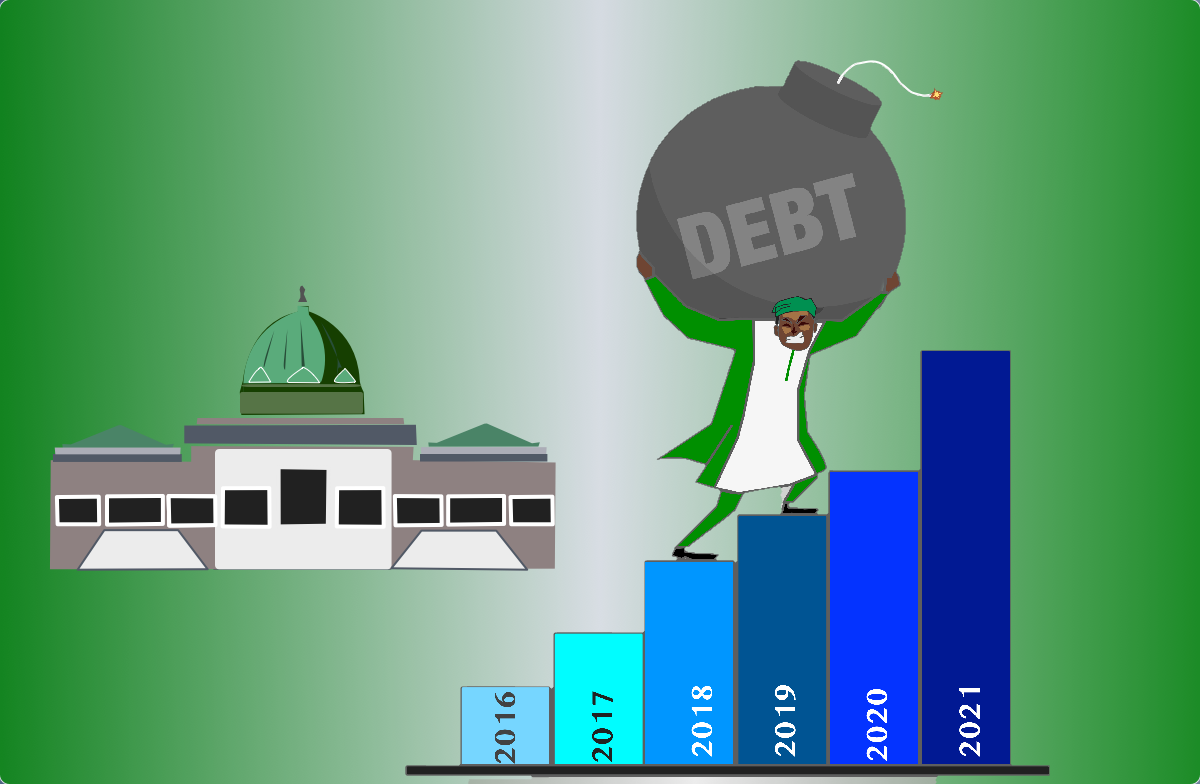

Acknowledging that Nigeria is sitting in a ticking time-bomb, Patience Oniha, the director-general of DMO, blamed the problem on the Covid-19 pandemic. She said the rate of borrowing had started to come down until coronavirus forced Nigeria, like many other nations, to increase its borrowing in order to buoy the economy.

Ms Oniha said, “The higher level of borrowing from 2015 due to the revenue crash occasioned by crude oil started trending downwards thereafter. Unfortunately, Covid-19 reversed that trend, as borrowing became necessary and many countries including the UK and US also embarked on new borrowing.

“It is not correct to say that the economic team is not concerned about how the debt will be repaid. You know that a Debt Sustainability Analysis and Medium Term Debt Strategy are done.”

Statistics obtained from the DMO showed that Nigeria borrowed a total of N5.52tn in 2020 and the total public debt to the gross domestic product (GDP) ration was 21.61%. However, Ms Oniha added that this was within Nigeria’s new limit of 40%.

However, the DMO stated that new borrowing to part-finance budget deficits had declined steadily from N2.36tn in 2017 to N2.01tn in 2018, N1.61tn in 2019 and N1.59tn in the first 2020 Appropriation Act. This trend was reversed in 2020 due to the economic and social impact of the Covid-19 pandemic as new borrowing in the revised 2020 Appropriation Act totalled N4.2tn.

Ms Oniha added: “It should be noted though, that apart from the new domestic borrowing of N2.3tn, the other new borrowings were concessional loans from the International Monetary Fund ($3.34bn) and other multilateral and bilateral lenders. This incremental borrowing to part-finance the 2020 budget and the additional issuance of promissory notes to settle some arrears of the Federal Government of Nigeria, contributed to the increase in public debt stock.

Dr Muda Yusuf, the director-general of the Lagos Chamber of Commerce and Industry, said: “The governor of Edo State has not said anything new. The situation is even worse than the picture he painted as the CBN financing of government deficit has reached unprecedented levels in recent years.

“In 2020, it was in excess of N2tn. In monetary parlance, it is referred to as Ways and Means financing by the CBN.”

When it comes to external debt, 9.7% of the total or N1.2trn ($3.3bn) is owed to the Export-Import Bank of China, the state-owned and funded bank that supports China’s foreign trade and investment. Multilateral debt, or debt owed to international financial institutions such as the African Development Bank, the World Bank and the International Monetary Fund, currently totals $17.9bn.