There are no products in your shopping cart.

| 0 Items | £0.00 |

VICE president Professor Yemi Osinbajo has revealed that Nigeria needs to attract a minimum of N2.3trn ($6bn) in capital investment annually over the next 30 years if the nation wants to confront her infrastructural deficit problems.

Despite having a population of over 200m, Nigeria only has a gross domestic product (GDP) of about $375bn, and an annual budget of a meagre $30bn. With foreign direct investment (FDI) in short supply, especially as the effects of the coronavirus pandemic bite, Nigeria is struggling to attract the required capital to invest in her infrastructure like power supply, railway networks, roads, water plants, sea ports, etc.

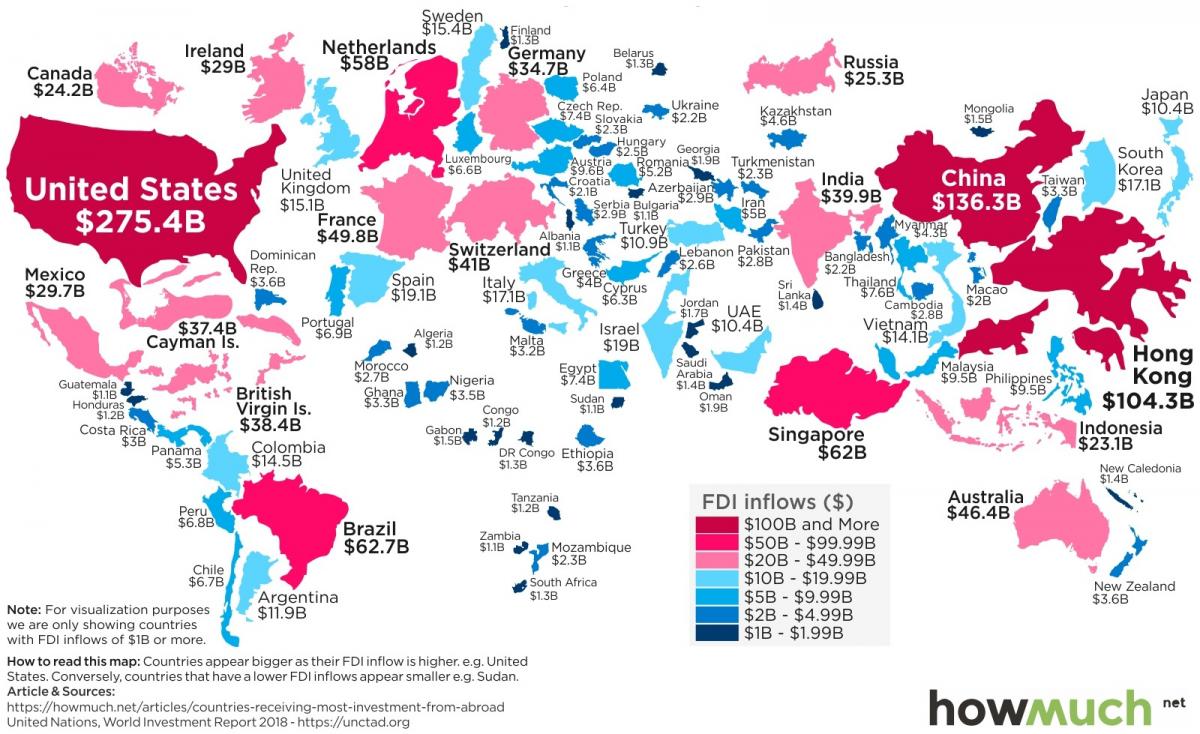

According to a United Nations Conference on Trade and Development (Unctad) report, Nigeria only attracted $3.5bn worth of FDI in 2019, compared with say the $62.7bn of Brazil, the $29.7bn of Mexico, the $23.1bn of Indonesia and the $9.5bn of the Philippines. Professor Osinbajo pointed out that since the government’s resources were completely insufficient, the only way to bridge the gap was by public-private partnership (PPP) arrangement in one form or the other.

Speaking at the opening of a two-day retreat of the National Council on Privatisation which will among other things deliberate the proposed amendment of the Public Enterprises Act 1999, Professor Osinbajo cited statistics from Nigerian Integrated Infrastructure Masterplan and the Economic Recovery and Growth Plan 2017-2020 to buttress his point. His paper titled How to Access Local, Global Funds to Develop Nigeria’s Infrastructure, pointed out that while government can take either commercial or concessionary loans for infrastructure development, that will be an additional burden on a usually considerably leveraged balance sheet.

Professor Osinbajo said: “Nigeria will require at least $2.3trn over the next 30 years to bridge this gap. The review of budgetary allocation for capital expenditure even over the past decade will show that government resources are completely insufficient for this purpose.”

“There is a large pool of investable funds from both local and international investors for the development and maintenance of infrastructure but these are only accessible where there is a business case to be made for developing public infrastructure. So, for both institutional and individual investors, there is far more comfort with lending or with equity participation where a private sector entity partners with a public authority owner of the infrastructure.

“This way the public partner can play its natural role of a regulator, leaving business to the private sector whose reason for being is business. So, for investors, PPP presents the best of both worlds.”

While urging participants drawn from the private and public sectors at the retreat to remain focused on the objectives of the meeting, Professor Osinbajo emphasised that developing a framework that will be attractive to investors should be topmost in their deliberations. In his opening remarks, Alex Okoh, the director-general of the Bureau of Public Enterprise (BPE) said the current economic environment requires the government to adopt innovative ways of attracting resources for infrastructure development.

He added that an amendment of the BPE Act would among other things expand private sector participation in the Nigerian economy as well as attract more foreign capital to different sectors of the economy. So far, diaspora remittances of $25bn a year are the largest source of funding into the Nigerian economy.