There are no products in your shopping cart.

| 0 Items | £0.00 |

Ayo Akinfe

Foreign direct investment (FDI) figures

(1) US -$4bn

(2) UK - $2bn

(3) Hong Kong - $1.9bn

(4) China - $1.5bn

(5) Ireland - $1.47bn

(6) Brazil - $778.5m

(7) Mexico - $500m

(8) India - $367.5m

(9) Vietnam - $318.7m

(10) South Africa - $139.2m

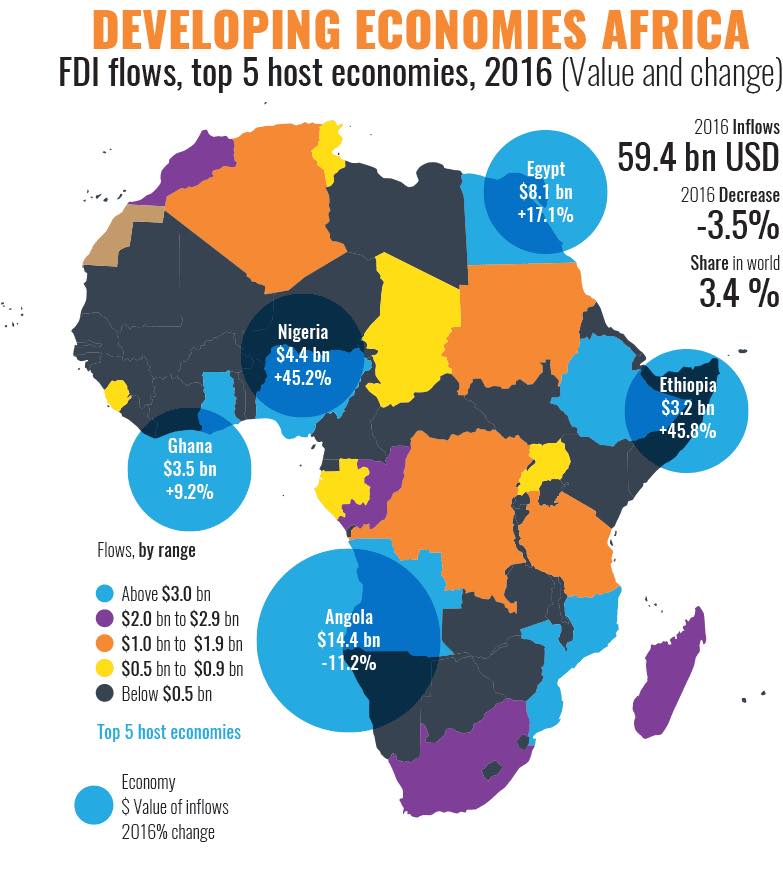

For Nigeria, the annual FDI figure was $118m. Given that we do not have a thriving domestic bourgeoisie who can fill the vacuum, how are we going to manage?

When I look at Dangote’s $20bn investment in that Lekki oil refinery, I keep asking how can Nigeria attract that kind of FDI on an annual basis. We need it if we are to diversify our economy and get out of this rut!