There are no products in your shopping cart.

| 0 Items | £0.00 |

CENTRAL Bank of Nigeria (CBN) experts have advised importers of Chinese products to get their invoices in the local currency the renminbi (RMB) rather than the US dollar as it will enable them to pay less duty.

CENTRAL Bank of Nigeria (CBN) experts have advised importers of Chinese products to get their invoices in the local currency the renminbi (RMB) rather than the US dollar as it will enable them to pay less duty.

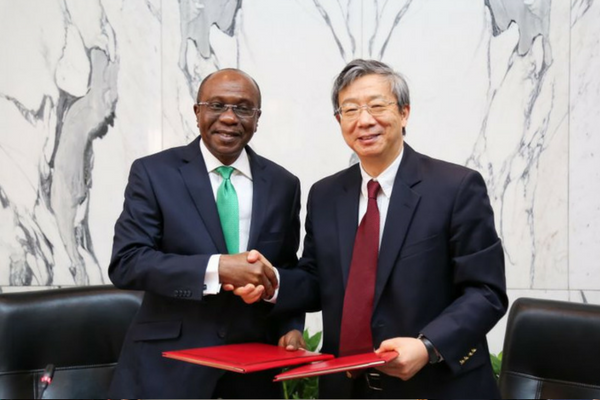

Recently, the CBN signed a three year bilateral currency swap agreement with the People’s Bank of China (PBoC) worth about $2.5bn. This renewable deal will allow for the direct exchange of RMB and naira for the purpose of trade and direct investment between the two countries.

After a meeting in Lagos yesterday, the CBN bankers committee made up of commercial and merchant banks’ chief executives, said the need to keep the naira stable prompted the bank to enter into the agreement with the PBoC. In local currencies, the swap is worth RMB15bn or N720bn, effectively, giving Nigerian importers a discount for making purchases in renminbi.

According to the CBN, the discount was meant to encourage importers to go for the renminbi instead of dollars as this will help protect Nigeria’s foreign exchange reserves, which are in dollars. Stanbic IBTC Bank managing director Demola Sogunle, said that in terms of the overall cost, importers who submit renminbi invoices will pay less.

He added: “Specifically on the renminbi and what is in it for importers, the idea is that the CBN is encouraging importers to receive invoices in renminbi instead of dollars. One of the incentives is that there is a percentage spread, which is yet to be determined but it is actually given to any importer that is bringing renminbi invoices for settlement, instead of dollar invoices.”

"Such importers will avoid 10% mark-up prices usually associated with dollar importation. China remains Nigeria’s biggest trading partner and the currency swap deal is expected to help small and medium enterprises grow their businesses."

According to Mr Sogunle, the logic is that if we are able as a country, to bring in machinery and equipment, without depleting the foreign reserves, the external reserves will not be under threat. He also said invoices that are domiciled in renminbi do not affect the foreign exchange reserves, now at $48bn.

Mr Sogunle added: “So, when you look at the overall cost, in terms of naira, if you bring renminbi invoices, it is going to be cheaper for the importer coming to the CBN to get foreign currency, which in this case will be renminbi. The importer will have to bring lesser amount of naira, so if he goes ahead to bring from the same supplier, based in China and makes the invoice in dollars, it is going to cost more, in terms of the naira amount he is going to use to get the foreign currency.”

“And do not forget, let’s link what we are talking about to external reserves, which will not be under threat as there is RMB15bn in place, in this bilateral currency swap. We are in a very good position, and that is why it is important to encourage importers to bring invoices in renminbi, instead of dollars.”

Ahmad Abdullahi, the CBN's director of banking supervision, said the drop in inflation rate to 11.61% in May and rise to $48bn of foreign reserves, as well as the 2.44% projected gross domestic product growth for 2018 are all positive indicators for the economy. He added that the CBN had enough in its arsenal to keep the naira stable and is prepared to ensure stability in the foreign exchange market.

United Bank for Africa managing director Kennedy Uzoka, also assured that the CBN was strong enough to keep defending the naira. He said the regulator made it possible for all the banks to sell personal travel allowance and business travel allowance to travellers at all their branches, including persons that do not have bank accounts with the lenders.

According to the PBoC, the swap is to facilitate bilateral trade, direct investment and safeguard financial market stability. It is expected to reduce the demand for the US dollar by Nigerians importing from China and consequently strengthen the value of the naira.

Also, the deal is expected to reduce certain barriers for Nigerian importers of goods from China and reduce the cost of transactions in multiple currencies. China has been one of Nigeria’s largest import partners over the last five years, with Chinese imports accounting for an average of 20.95% of total imports between 2013 and 2017.

Nigerian imports from China increased by 21.16% to N1.79trn in 2017 from N1.48trn in 2013, while Nigeria’s exports to China averaged just 1.50% of the total over the period. Exports to China increased by 28.99% to N220.57bn in 2017 from N171bn in 2013.